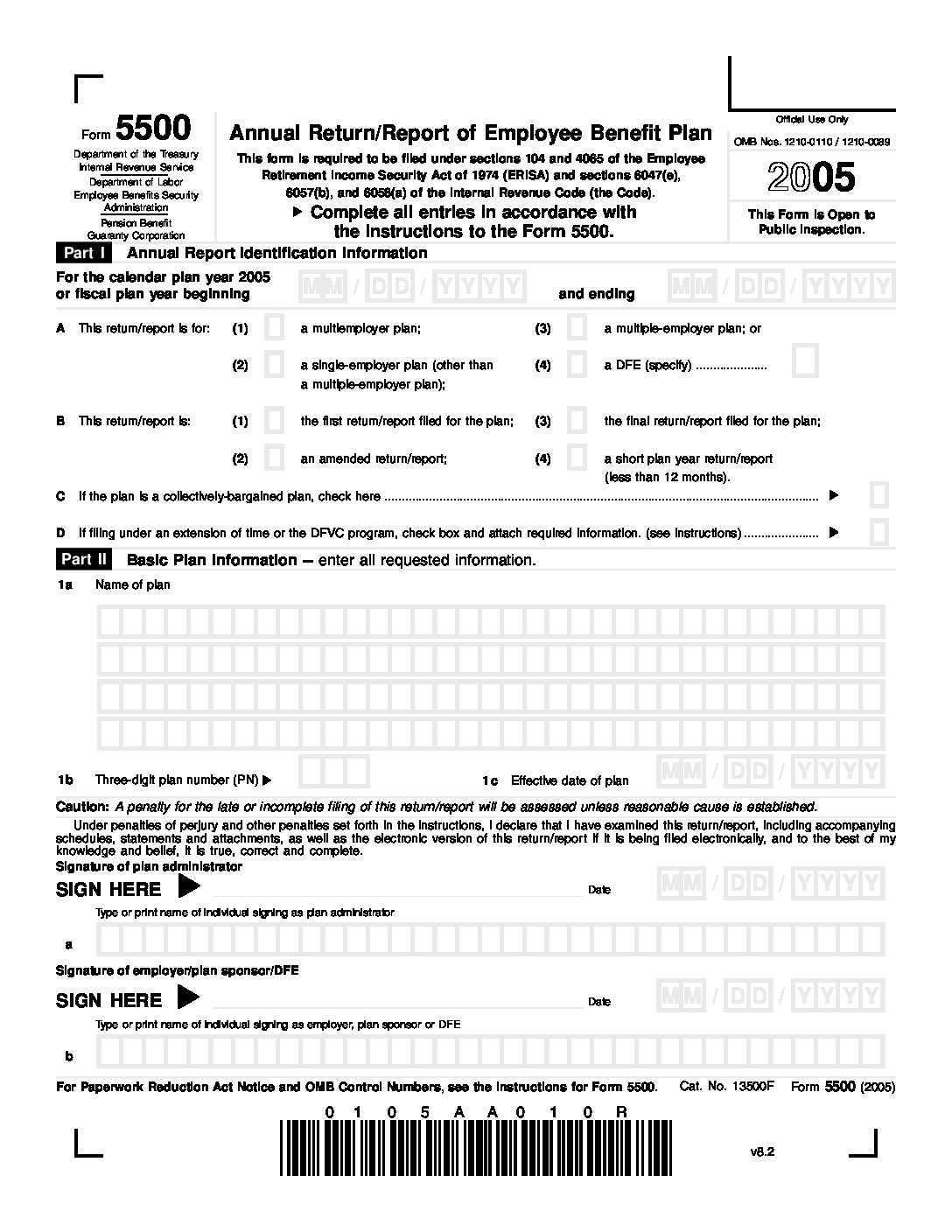

Arizona Form A-4 Effective January 31, 2023

All Arizona employers must provide the new tax rate options to their employees by January 31, 2023, either electronically through an online portal, fillable form, or paper form.

All Arizona employers must provide the new tax rate options to their employees by January 31, 2023, either electronically through an online portal, fillable form, or paper form.

Effective January 1, 2023, Wallace Plese + Dreher promoted several employees. Learn about their diverse backgrounds and experience.

In June 2022, the IRS made a rare midyear adjustment to mileage deductions because of rising gas costs. For 2023, the IRS increased the number again.

Taxpayers have until Tuesday, April 18, 2023, to file their 2022 tax return since April 15, 2023 falls on a federal holiday. If filing an extension, the extended due date to file the income tax return is October 16, 2023 because October 15, 2023 falls on a Sunday.

Wallace Plese + Dreher’s employees enjoyed a unique holiday experience at the Phoenix ZooLights.

If you expect to itemize deductions in 2022, you may benefit from contributions to qualified charitable organizations. As long as you make a donation in 2022, it is deductible on your 2022 return, including charging the donation to a credit card on December 31.

Effective for 2022, private companies that issue financial statements prepared under U.S. GAAP are required to conform to a new lease accounting standard affecting their 2022 financial statements. Changes from the new lease accounting standard should be reflected in annual financial statements issued in 2023.

Arizona’s Individual Income Tax Withholding Form, Arizona Form A-4, has been updated to reflect Arizona’s lower individual income tax rates. By January 31, 2023, every Arizona employer is required to make this form available to its Arizona employees.

Many homeowners sell their houses at a profit, which raises questions about taxation. Fortunately, the IRS gives breaks on these profits. Learn about the details that can save you a lot of money.

Companies with remote and in-person employees should create a plan to measure achievements in all situations.

If you are interested in claiming the EV tax credit for purchasing a new electric vehicle after August 16, 2022, a tax credit is generally available only for qualifying electric vehicles where final assembly occurred in North America. A transition rule applies for electric vehicles purchased before August 16, 2022.

How do you know if your Arizona company has too few or too many employees? Do you know the best way to adapt your workforce as your company grows and develops?

Additional benefits on top of an employee’s regular pay may be taxable. The rules are complicated and employers should familiarize themselves with the requirements. Do you know which benefits are taxable?

As a teambuilding activity, our people used their communication, critical thinking, observation, and problem solving skills while participating in several escape room games.

How do you think about the people who work for your company? You are on the right track if you believe they are valuable individuals who contribute to your success. A company’s intangible assets, including human capital and culture, comprise more than half of a company’s market value on average.

Are you seeking a profession that is respected and known for its integrity and ethics? Do you want to interact with influential business leaders in the Arizona community? You can experience these things in public accounting with Wallace Plese + Dreher.

Maintaining accurate records, keeping track of your company’s finances, bookkeeping, taxes, accounts receivable, accounts payable, and financial reporting takes a lot of time. This may be the right time to get help with these important tasks.

Depreciation is an annual tax deduction that allows small businesses to recover costs of certain property that decreases in value over its lifetime. It is an allowance for wear and tear, deterioration, or obsolescence of the property.

As part of our workplace culture, we take time to give back to charitable organizations. Our most recent community effort involved packing meals for malnourished children. Everyone that participated felt grateful for what we take for granted everyday: food.

By 2023, Google will eliminate cookies and institute Topics, which supports interest-based advertising. A person’s browser will determine a handful of broad topics based on their browsing history. With increased concerns about privacy, many companies have been forced to make changes to how they use data.

As a teambuilding activity, our people took part in a new experience: axe throwing. Conducted in a safe environment, at BATL in Scottsdale, it was a fun and first-time experience for many who attended.

Businesses or individuals who purchase a plane, boat, or vehicle from an out-of-state vendor may be subject to use tax, which is a tax on purchases made out-of-state for taxable items stored, used, or consumed in Arizona when the sale was not subject to transaction privilege tax (TPT).

Selling or acquiring a business is a new experience for most business owners. One key to a successful sale or purchase is using a CPA well-versed in current tax regulations and laws.

Some people believe an easy way to avoid probate is to add your children to your bank accounts and deed. This strategy may not work as planned.

Auditors of employee benefit plan financial statements have new performance requirements. Employee benefit plan administrators and those charged with governance should become familiar with the new requirements.

Wallace Plese + Dreher voted as one of the 100 Best Places to Work and Live in Arizona for 2022, as recognized by Ranking Arizona.

Effective July 1, 2022, standard mileage rates for business travel is 62.5 cents per mile. Recognizing recent gas price increases, the IRS made a special adjustment for the final months of 2022.

In 2020, the FBI reported over a million cybercrime complaints, mostly from identity theft. The time period reported in these statistics corresponds to remote work due to the COVID-19 pandemic. This should be a warning to businesses and individuals who have not taken steps to protect their sensitive information from hacking, phishing, or malware.

The deadline for obtaining a voluntary Arizona Travel ID is May 3, 2023. The Arizona Motor Vehicle Department (DVD) urges everyone to act soon to obtain the new Arizona Travel ID.

Understanding the importance of establishing meaningful relationships inside and outside the office, partners and employees took part in the FRIENDS Experience Phoenix.

You should keep tax records for three years after you file a return, but there are times when you will need older files.

Are you having a hard time finding accounting and bookkeeping help for your Arizona business? Accounting and bookkeeping specialists can be a cost-effective option for your company.

Whether your business brings in $50,000 a year or $50 million, it needs an effective bill-paying system. Here are useful tips on building and managing an efficient accounts payable process.

The Foreign Account Tax Compliance Act (FATCA) requires that U.S. individuals who hold foreign financial assets must report those assets to the IRS. What are your responsibilities under FATCA rules?

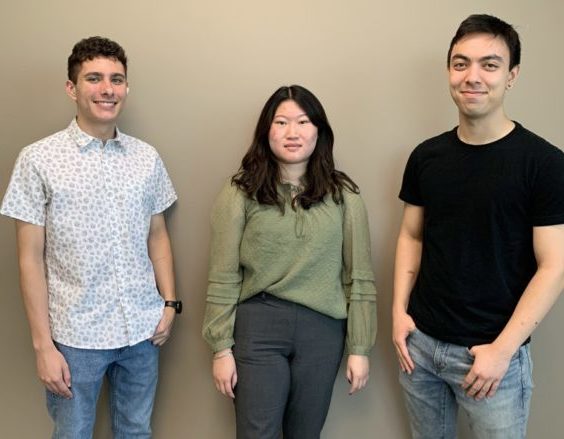

Wallace Plese + Dreher welcomed three interns to the Firm for the 2022 tax season. They are attending Arizona State University (ASU), W.P. Carey School of Business, and expected to graduate in May 2024.

Randy G. Brammer, CPA recognized as an hands-on professional in People & Projects to Know (PTK) in Commercial Real Estate 2022.

Your business cannot operate without enough cash to cover at least 60-90 days of expenses. Do you monitor your cash flow at least on a weekly basis?

Wallace Plese + Dreher sponsored the Annual International State of the State with Governor Doug Ducey hosted by the Phoenix Committee on Foreign Relations (PCFR).

Arizona small businesses may elect to file a separate small business income tax return to report their share of Arizona small business gross income. A taxpayer makes the small business income tax election by timely filing a Small Business Income Tax return along with their timely filed individual income tax form.

ADOR issued guidance for taxpayers who are affected by the recent Maricopa County Superior Court ruling striking down the surcharge imposed by Proposition 208. Taxpayers who have already filed do not need to amend their tax returns.

What are some common tax myths and facts about filing taxes? If you file a tax extension, do you still need to pay taxes owed? Are minor children required to pay taxes on income?

Tax years are based on annual accounting periods where you keep records and report income and expenses. A tax year may not be a calendar year. Discover the annual accounting periods you may or may not adopt.

How can you tell if a deal makes practical and financial sense? A short question with a complicated answer. Knowing the basics of when or if a deal makes practical and financial sense is helpful, but seeking help from a CPA to analyze the pros and cons is essential.

The IRS provided further details on additional transition relief for certain domestic partnerships and S corporations preparing the new schedules K-2 and K-3 to further ease the change to these new schedules.

The IRS compiled a list of its most famous and high-profile investigations of 2021. The most prominent case was a family sentenced to prison for fraudulently receiving millions of dollars in COVID money.

Collaboration with your Arizona accounting firm should be part of your process when making business decisions. Your accounting firm should listen and help you make strategic moves to grow your company. Perhaps, you have heard your accountants refer to themselves as a crossing guard directing traffic, hoping everyone makes it across safe and sound.

Congratulations to Randy G. Brammer, CPA on his selection as a 2022 Arizona Business Leader. Randy was selected from more than 5,000 Arizona business leaders in a number of industries, including construction, real estate, banking, and financial services.

Wallace Plese + Dreher promoted 15 employees ranging from Tax Senior to Senior Tax Manager. Some employees started their careers with the Firm, others transition from industry to public accounting, and some joined the Firm after graduating college.

Many people believe tax deductions and credits are the same. Tax deductions reduce your taxable income, but tax credits reduce your tax bill dollar for dollar. Knowing how they work can help you understand your tax situation.

Recent guidance from the IRS highlights the nature of advertising costs. The tax law allows businesses to deduct expenses that help them bring in new customers and keep existing ones. What expenses can a business deduct?