Retirement Plan Contributions

The IRS announced the amount individuals can contribute to their 401(k) plans in 2025 has increased to $23,500, up from $23,000 for 2024.

The IRS announced the amount individuals can contribute to their 401(k) plans in 2025 has increased to $23,500, up from $23,000 for 2024.

Auditors of employee benefit plan financial statements have new performance requirements. Employee benefit plan administrators and those charged with governance should become familiar with the new requirements.

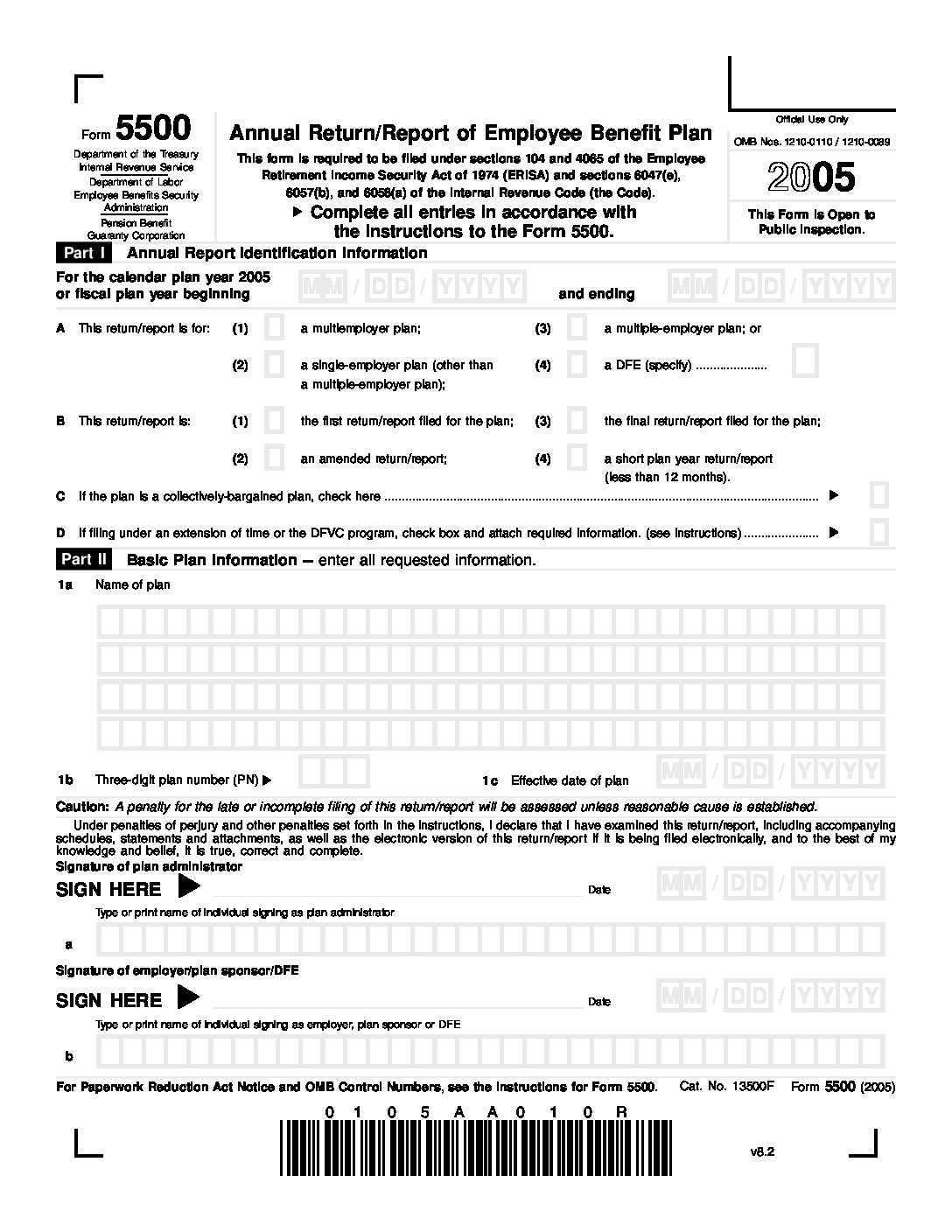

Sponsors of retirement plans are required by law to report information to the IRS, the Department of Labor (DOL), and Pension Benefit Guarantee Corporation (PBGC). Your plan type, business size, and circumstances affect the type of information, forms, and disclosure requirements.

The benefits of retirement programs, for both companies and employees, can be substantial, but the rules are complicated. You need to figure out how to help your employees while being compliant.

The IRS is reminding taxpayers about the rules for required minimum distributions (RMDs) from retirement accounts. Previous rules stated that a retirement plan account owner must begin taking an RMD annually starting the year they reach 70½ or 72, depending on the birthdate and retirement year of the plan owner.

A company-sponsored retirement plan is one of the most popular benefits a business can offer its employees, and there are many advantages and compelling employer benefits as well. Tax advantages, investing opportunities, and matching contributions are just three of the benefits of a 401(k) plan for employees.