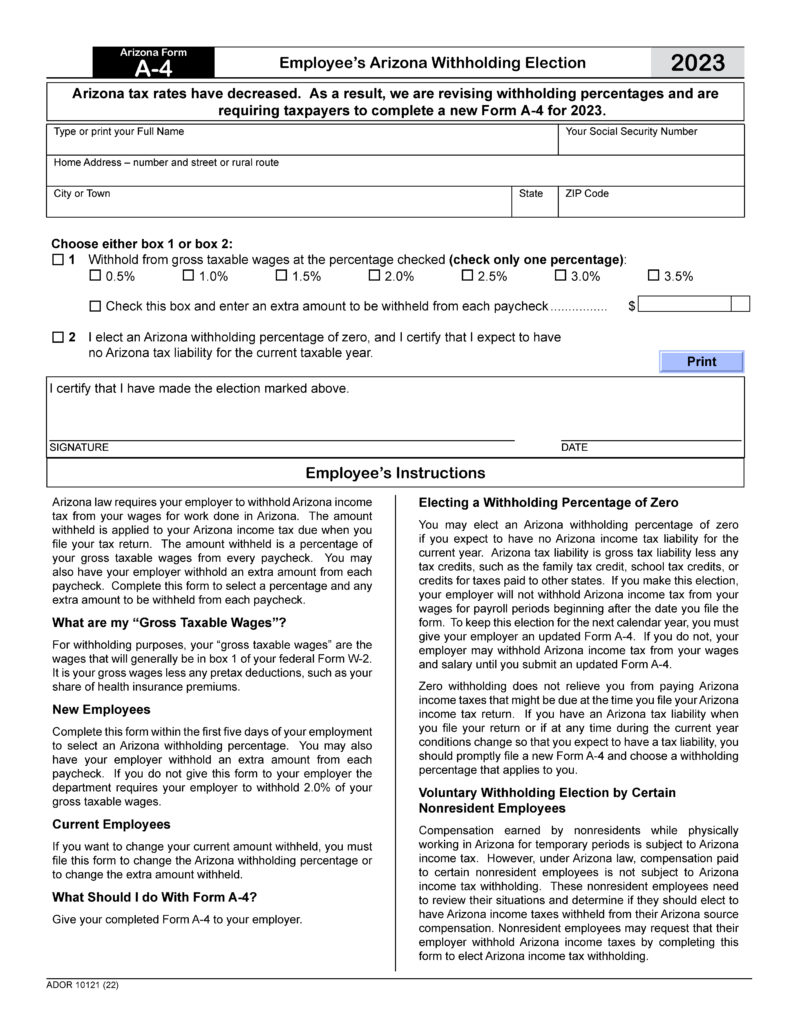

Arizona’s Individual Income Tax Withholding Form, Arizona Form A-4, has been updated to reflect Arizona’s lower individual income tax rates. By January 31, 2023, every Arizona employer is required to make this form available to its Arizona employees. The new A-4 form has seven new withholding election rate boxes. It retains both the zero withholding rate option and additional Arizona withholding line. The default rate will be 2.0% if an employee fails to fill out the new A-4 form. The employer and employee should keep the A-4 form for their tax records. The withholding form should not be sent to the Arizona Department of Revenue (ADOR).

Arizona’s Individual Income Tax Withholding Form, Arizona Form A-4, has been updated to reflect Arizona’s lower individual income tax rates. By January 31, 2023, every Arizona employer is required to make this form available to its Arizona employees. The new A-4 form has seven new withholding election rate boxes. It retains both the zero withholding rate option and additional Arizona withholding line. The default rate will be 2.0% if an employee fails to fill out the new A-4 form. The employer and employee should keep the A-4 form for their tax records. The withholding form should not be sent to the Arizona Department of Revenue (ADOR).

In the 2021 session, the Arizona Legislature passed Senate Bill 1828, reducing Arizona’s individual income tax rates and the Form A-4 had to be updated to reflect the new lower income tax rates. If the employee does not update their old Arizona Form A-4, the employer should select the new Arizona withholding rate of 2.0% on behalf of the employee. Employees will still have the option of selecting a higher Arizona withholding rate than their wages might dictate and there is still a line to add an additional amount of Arizona withholding.

If the employer uses an electronic A-4 form for their employees instead of a paper form, the electronic form can be updated to reflect the new withholding rate percentages.

2022 and 2023 Tax Rates

For tax year 2022, there are two individual income tax rates, 2.55% and 2.98%. The new flat tax of 2.5% will affect the 2023 tax year which is filed by April 2024.