Arizona Tax Filing Requirements

The Arizona Department of Revenue (ADOR) provides individual income tax filing tips for 2024 tax returns and important due dates.

The Arizona Department of Revenue (ADOR) provides individual income tax filing tips for 2024 tax returns and important due dates.

The Arizona Department of Revenue (ADOR) encourages taxpayers to keep well-organized records and to securely discard old documents.

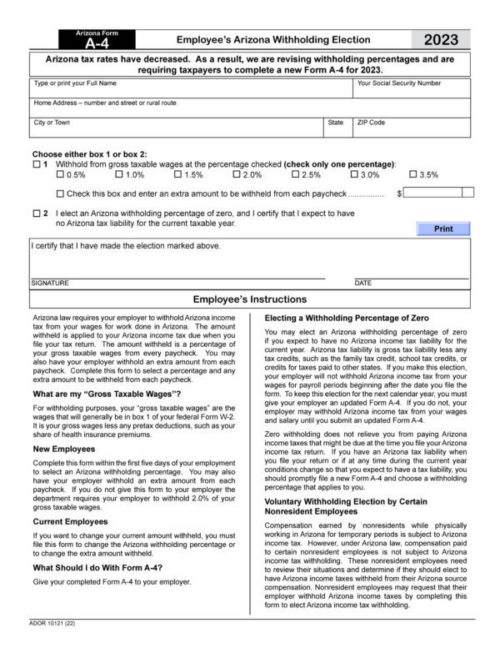

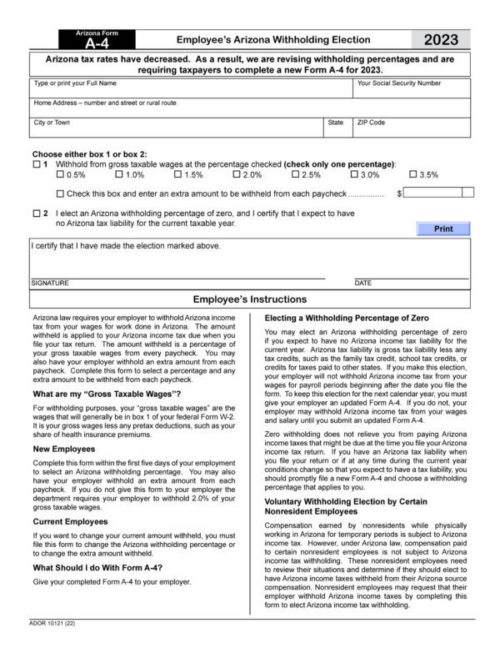

All Arizona employers must provide the new tax rate options to their employees by January 31, 2023, either electronically through an online portal, fillable form, or paper form.

Taxpayers have until Tuesday, April 18, 2023, to file their 2022 tax return since April 15, 2023 falls on a federal holiday. If filing an extension, the extended due date to file the income tax return is October 16, 2023 because October 15, 2023 falls on a Sunday.

If you expect to itemize deductions in 2022, you may benefit from contributions to qualified charitable organizations. As long as you make a donation in 2022, it is deductible on your 2022 return, including charging the donation to a credit card on December 31.

Arizona’s Individual Income Tax Withholding Form, Arizona Form A-4, has been updated to reflect Arizona’s lower individual income tax rates. By January 31, 2023, every Arizona employer is required to make this form available to its Arizona employees.

Arizona small businesses may elect to file a separate small business income tax return to report their share of Arizona small business gross income. A taxpayer makes the small business income tax election by timely filing a Small Business Income Tax return along with their timely filed individual income tax form.

How can you tell if a deal makes practical and financial sense? A short question with a complicated answer. Knowing the basics of when or if a deal makes practical and financial sense is helpful, but seeking help from a CPA to analyze the pros and cons is essential.

Senate Bill 1783 allows individual taxpayers to elect to have their Arizona small business adjusted gross income removed from their regular individual income tax return and taxed on a separate Arizona small business income tax return. For taxable years beginning from and after December 31, 2020, a small business taxpayer may elect to file a return for the taxable year with the Arizona Department of Revenue (ADOR) to report that small business taxpayer’s share of Arizona small business gross income.

On April 14, 2021, Governor Ducey signed Senate Bill 1752, which conformed to the definition of federal adjusted gross income (federal taxable income, for corporations), including federal changes made during 2020 as well as through the 2021 American Rescue Plan.

As of April 5, 2021, the Arizona State Legislature is currently considering a bill that would extend the Arizona filing deadline for individual filers to May 17. ADOR is actively monitoring the bill as it goes through the legislative process.

Federal individual and calendar year corporate returns (except S Corporations) are due October 15, 2020, and calendar year fiduciary returns were due September 30, 2020.